Clean Energy Global Finance Initiative

BNEF “Mapping the Gap”, January 2016

1 Provide a free, easy to access database of public and private funding and financing sources for clean energy investments in developing countries—starting with Asia, Africa, and the Pacific Islands;

2 Regularly highlight new funding sources and financing initiatives through social and other media;

3 Curate examples of clean energy finance programmatic and policy successes from emerging markets worldwide;

4 Showcase live examples, including smaller but eminently scalable programs;

5 Translate this new information into specific program design suggestions and policy recommendations—identifying existing funding gaps and highlighting promising new trends and opportunities. These periodic policy pronouncements will be formulated with the support of a Policy Advisory Committee comprising senior financial experts.

Expected outcomes of the initiative include:

Developers will be able to identify available funding/financing sources for clean energy projects in specific countries. |

Public and private financiers will receive periodic analysis on existing gaps in the market, by location, thereby prompting financing responses |

|

Up-to-date information on MDB/bilateral financing products and guarantees, as well as on new private bank, investment bank and commercial bank offerings will be available in a free and centrally available database. |

The entrance of developers in traditionally riskprone markets will be encouraged, based on the availability of financing supports and funding. |

Rachel Kyte, Accelerating Energy Efficiency under SE4All, February 2016

The BNEF Mapping the Gap analysis process reinforced the need for urgency in accelerating investment in climate solutions. By tracking current and emerging financing and funding instruments available in Asia, Africa and the Pacific Islands—and providing important analysis regarding what is needed in the market in order to accelerate clean energy financing and implementation—the CEGFI is designed to facilitate that journey.

CEGFI Program Elements

The goal of the CEGFI database is to accelerate investment flows and enable the needed exponential increase in clean energy investment, by more effectively matching investors with potential support, and helping policy makers and investors efficiently identify and resolve impediments to clean energy financial flows.

CEGFI Database

The CEGFI database will provide an easily accessible, fully searchable and continuously updated resource that lists all identified public and—to the extent possible—private funding and financing sources for renewable energy and energy efficiency investment in Asia, Africa and the Pacific Islands. The database will contain information compiled on an ongoing basis from:

Local, regional and international development banks;

National, bilateral and international investment support entities and clean energy financing programs;

Foundation-supported development finance programs;

Emerging private industry and financing initiatives; and

Key information outlets covering new initiatives in local markets (in collaboration with Bloomberg New Energy Finance).

The database system, maintained by CEGFI and the International Institute for Energy Conservation, will be fully searchable and sortable— by country, funder, technology, type of financing vehicle, date of availability, etc. The database will:

Aggregate information: The comprehensive data set will help in-country developers identify funding and financing sources for local projects, and will enable external developers to survey resources available to fund clean energy projects across national markets.

Highlight new resources: Advanced database features will draw attention to new and expanded public financing products and guarantees, as well as emerging private bank, investment bank and commercial finance offerings.

Identify gaps: The database sorting functions will enable public and private financiers to easily identify financing gaps in individual markets (e.g., specific subsectors, countries or regions), catalyzing the development of effective commercial financing responses or the design of new 3rd party guarantees.

Promote investment in emerging regions: Enhanced awareness of the availability of financing and risk mitigation tools in emerging regions will encourage developers to enter traditionally high-risk markets.

Given the need for and projected expansion of clean energy investment in emerging markets, the scope of the CEGFI database will grow and evolve over time. The database will track current and emerging financing and funding instruments available in the target regions, and will publicize new offerings when they are announced by funding and financing providers.

CEGFI Policy Forum

The CEGFI Policy Forum will be an ongoing policy dialogue supported by a high-level Policy Advisory Committee (PAC). Quarterly Committee meetings will focus serially on a range of cross-cutting topics identified by the members as essential for accelerating clean energy deployment in the CEGFI markets.

Based on the real-time trends identified through the CEGFI database and the deliberations of the PAC, the Forum will deliver financial insights to both the providers and consumers of clean energy finance in the developing world. It will highlight promising clean energy finance developments, identify current structural financing gaps, and provide input on developments needed in the market to accelerate clean energy financing.

Major regional or global challenges to expanded clean energy deployment will be identified by the Committee members and prioritized for discussion. CEGFI staff will research and prepare materials for the Committee, and record its recommendations after each session. In those cases where deliberations highlight the need for further research to inform the Committee’s deliberations, staffsupported working groups will investigate these priority topics in more detail and provide feedback to the PAC.

Discussions of individual national markets will include underlying trends and impediments to accelerated clean energy capital deployment. Committee members and staff will develop recommendations on needs and opportunities for addressing the current financing challenges.

Members of the Policy Advisory Committee are leaders in the field of clean energy finance with years of experience. To date, those who have agreed to serve on the PAC include:

Thomas Dreessen, President & CEO, EPS Capital, developing and financing ESCO and energy efficiency projects in Indonesia and China; based in Jakarta.

Benoit Lebot, Executive Director, International Partnership for Energy Efficiency Cooperation (IPEEC), which is implementing the G20 Energy Efficiency Action Plan; based in Paris.

Dilip Limaye, President & CEO, SRC Global Inc., renowned international energy efficiency finance expert, having completed projects all over the world; based in Philadelphia.

Peter Sweatman, CEO, Climate Strategy & Partners; Chairman, Energy Efficiency Capital Advisors, working on multiple international EE finance initiatives; based in Madrid.

Markus van der Burg, Managing Director, Conning Asset Management, EE & RE financier through the $345M European Clean Energy Fund; based in London.

The resulting observations and policy recommendations from the Forum will be widely disseminated through:

The CEGFI website

Social media

Op-eds and by-lined articles

CEGFI blog posts

Email blasts to CEGFI stakeholders (e.g., in the Forum’s quarterly reports).

CEGFI Builds Value

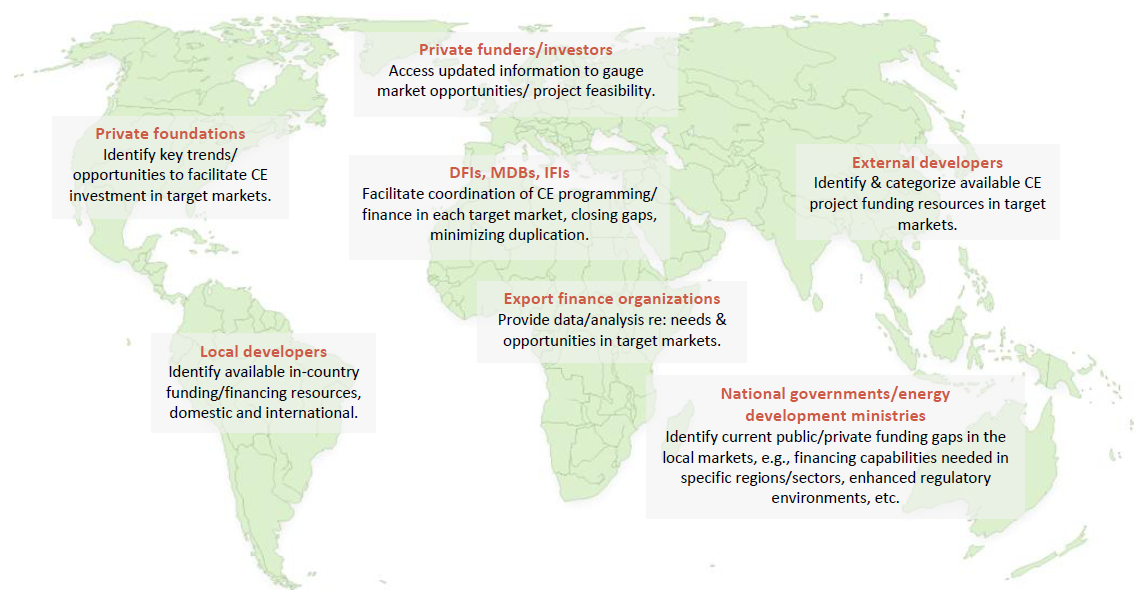

To accelerate the needed exponential increase in clean energy investment, the CEGFI will provide valuable information and services to all of the key providers and users of clean energy finance in developing and emerging economies.

Globally

Catalyze & facilitate increased CE investment; match providers/users of CE finance; help policy makers/investors identify & resolve impediments to CE financial flows.

1 New renewable electric power = solar, geothermal, and other of the most modern clean technologies, but not large hydro or nuclear. [back to top]